We may earn a commission for purchases through links on our site at no cost to you, Learn more.

- PayPal’s “Cash a Check” service is only for checks, not money orders.

- Money orders can be cashed at banks, credit unions, and post offices.

- Money orders are prepaid and guaranteed for payment, unlike personal checks.

- Banks often allow you to cash money orders, especially if you’re a customer.

- Credit unions may cash money orders for members, sometimes with a fee for non-members.

- Post offices will cash USPS-issued money orders for a small fee.

- You can deposit a money order into your bank account for easy access to funds.

- Alternatives to PayPal include prepaid debit cards or check cashing services.

Can I Cash a Money Order on PayPal?

In today’s digital world, many people rely on online platforms like PayPal for financial transactions. Whether you are buying goods, paying for services, or sending money to a friend, PayPal is a convenient solution.

However, if you’ve received a money order, you might be wondering, “Can I cash a money order on PayPal?” The answer is simple: No, you cannot directly cash a money order through PayPal. Let’s explore why this is the case and what alternatives are available.

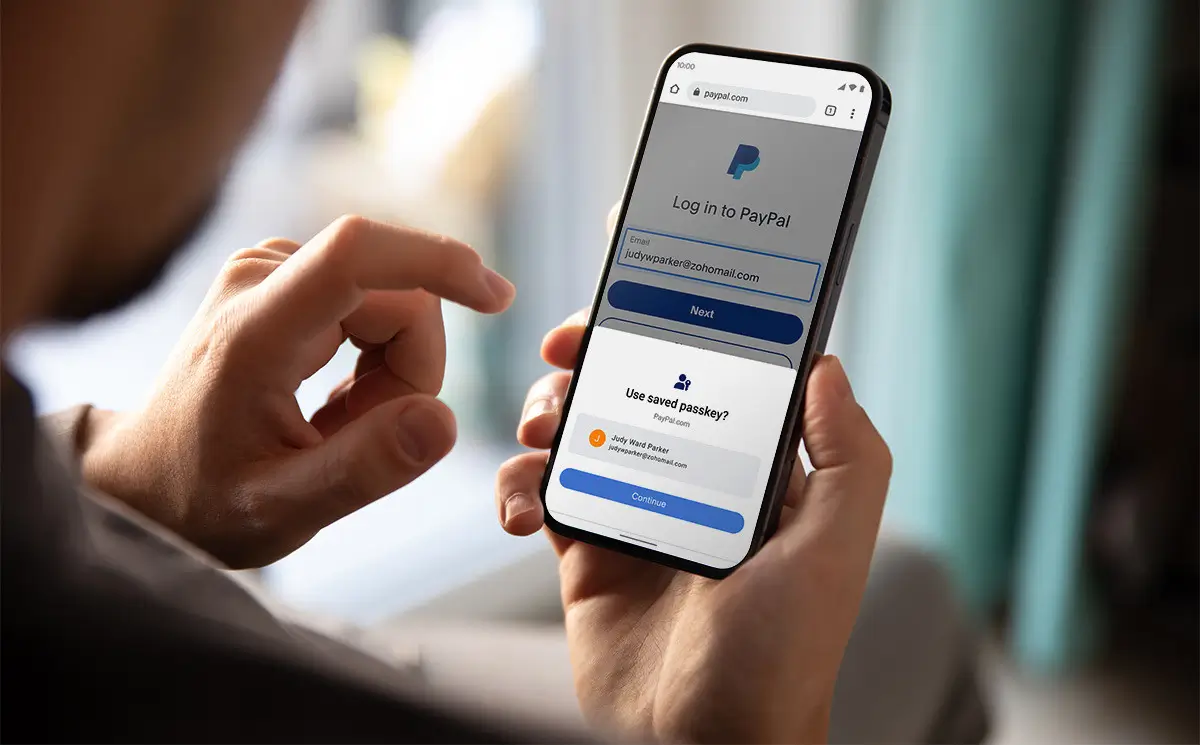

PayPal’s “Cash a Check” Service

PayPal offers a service called “Cash a Check,” which allows users to deposit checks into their PayPal accounts using the PayPal mobile app. This service is an excellent feature for people who do not have easy access to a bank or prefer to avoid physically visiting a branch. However, this service is designed exclusively for checks, not money orders.

Checks and money orders are similar forms of payment, but they are different in important ways. A check is typically drawn against a bank account, whereas a money order is prepaid and guaranteed for payment. Because PayPal’s “Cash a Check” service is designed to process checks and not money orders, it cannot be used for money orders.

If you’re holding a money order, unfortunately, you will need to use other methods to cash or deposit it. Let’s discuss the best options for cashing a money order.

How to Cash a Money Order

Although PayPal doesn’t support money orders, there are several places where you can cash a money order. The most common options include banks, credit unions, and post offices. Here’s what you need to know about each of these options.

1. Banks

Most major banks allow you to cash money orders, especially if the money order was issued by the same bank or a major provider like Western Union or MoneyGram. If you’re a customer of the bank, you may be able to cash the money order for free, or they might charge a small fee for the service.

If you’re not a customer of the bank, you may be charged a higher fee. It’s always a good idea to check with your bank for specific details on their money order cashing policies and fees.

2. Credit Unions

Credit unions are similar to banks but are typically non-profit organizations. Many credit unions offer money order cashing services to their members. If you’re a member of a credit union, you may be able to cash a money order for little to no fee.

If you’re not a member, some credit unions may still cash your money order, but they might charge a higher fee.

3. Post Offices

In many cases, you can cash a money order at the post office where it was issued. If the money order is from the United States Postal Service (USPS), they will cash it at any of their branches.

The post office will verify the money order and pay you the full amount, minus a small fee. This can be a good option, especially if you are unable to access a bank or credit union.

Money Orders Are Similar to Checks

Money orders and checks have a lot in common. Both are negotiable instruments used to transfer funds from one person to another. They are both widely accepted and can be used to pay bills, make purchases, or send money to others. However, there are key differences between them.

One of the most important differences is that money orders are prepaid. When you purchase a money order, the amount is paid upfront, and the issuer guarantees that the funds are available.

In contrast, checks are written against a checking account, and the funds may not be available if the account holder does not have sufficient funds in their account.

Another key difference is that money orders are typically issued by banks, post offices, or other financial institutions, while checks are issued by individuals or businesses from their own bank accounts. This makes money orders a more secure option, as they are guaranteed for payment.

Despite these differences, both money orders and checks can be cashed or deposited at banks, credit unions, and other financial institutions.

If You Have a Money Order, You Can Deposit It at a Financial Institution

If you need to deposit a money order, you can do so at most banks and credit unions. Just like with checks, you can either deposit the money order into your account or cash it. If you decide to deposit the money order, the funds will typically be available within one to three business days, depending on your bank’s policies.

When depositing a money order, be sure to endorse it by signing the back, just like you would with a check. You may also need to show identification, especially if you’re cashing a large money order or using a bank where you’re not a regular customer.

What Are Your Alternatives to Cashing a Money Order on PayPal?

Since you cannot cash a money order directly on PayPal, there are still several options available to you. Let’s take a look at some alternatives.

1. Use a Prepaid Debit Card

If you want to use the funds from a money order online or for purchases, consider using a prepaid debit card. Many prepaid cards allow you to deposit money orders and use the funds just like you would with a traditional bank account.

You can often load money orders onto the card by visiting participating locations or depositing the money order via mail. Some prepaid cards even allow you to use them for online purchases, making it easy to access your funds.

2. Send the Money to Your PayPal Account

If you want to use PayPal to receive the money from the money order, you can deposit the money order into your bank account first. Once the funds are available in your bank account, you can transfer them to your PayPal account. This process may take a few days, but it allows you to use PayPal for your online transactions.

3. Deposit the Money Order into Your Bank Account

If you have a bank account, you can deposit the money order directly into your account, either at the bank branch or through an ATM. This is one of the simplest ways to cash a money order and access the funds. Once the funds are in your bank account, you can transfer them to PayPal or use them however you choose.

4. Use a Check Cashing Service

If you don’t have access to a bank or prefer not to use one, you can use a check cashing service to cash the money order. These services typically charge a fee, but they allow you to get immediate access to the funds.

You can find check cashing services at retail locations, such as grocery stores and convenience stores, or at dedicated check cashing businesses.

Frequently Asked Questions

Here are some of the related questions people also ask:

Can PayPal cash a money order?

No, PayPal cannot cash a money order. The “Cash a Check” service in the PayPal app is only for checks, not money orders.

Where can I cash a money order?

You can cash a money order at banks, credit unions, or post offices. Some check-cashing services also offer this option.

Can I deposit a money order into my PayPal account?

You cannot deposit a money order directly into PayPal. However, you can deposit it into your bank account and then transfer the funds to PayPal.

What is the difference between a money order and a check?

A money order is prepaid and guaranteed for payment, while a check is written against a personal bank account and may not have sufficient funds.

How do I deposit a money order into my bank account?

To deposit a money order, sign the back and take it to your bank. You can deposit it in person at a branch or use an ATM that accepts deposits.

Can I cash a money order at a credit union?

Yes, many credit unions will cash money orders for their members, often with a small fee for non-members.

How can I use the money from a money order online?

You can deposit the money order into a bank account and transfer the funds to PayPal or use a prepaid debit card to load the money.

Is there a fee to cash a money order at a post office?

Yes, there is usually a small fee to cash a USPS-issued money order at the post office.

What is the best alternative to PayPal for cashing a money order?

Using a prepaid debit card, check-cashing service, or depositing the money order into your bank account are good alternatives to using PayPal.

The Bottom Line

So, can you cash a money order on PayPal? Unfortunately, the answer is no. PayPal’s “Cash a Check” service is specifically for checks, not money orders. However, this doesn’t mean you’re stuck with the money order.

There are several ways to cash or deposit a money order, including at banks, credit unions, post offices, or using check cashing services. If you want to use PayPal, you can deposit the money order into your bank account and transfer the funds to PayPal.

Understanding the differences between checks and money orders and knowing where to cash or deposit a money order can help you get access to your funds quickly and easily. Whether you choose to use a bank, credit union, or another service, you can find a solution that works for you.